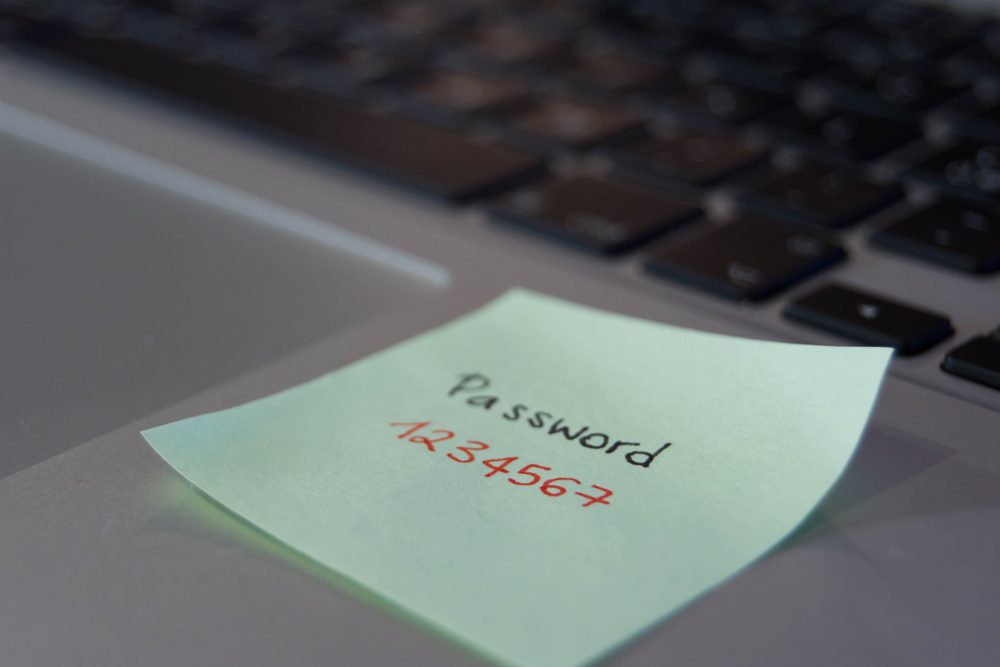

Password cheat sheet

If you have your password written somewhere, most likely on a piece of paper, you’re not the only one. In fact, 73% of people, according to a 2017 survey by the Pew Research Center, have more than one password written on a cheat sheet. From ATM card’s PIN to credit card accounts, the average American has cheat sheets with at least seven passwords that provide access to some of their most important assets.

Specialists say it’s a smart move to think of passwords consisting of a combination of letters, numbers, and symbols that you modify constantly. And whatever you do, don’t keep a password cheat sheet in your wallet.

One safe option to make sure no one else but you knows your passwords is to keep them in a locked box in your house. You could also resort to a digital password manager such as LastPass. You can have the premium service for $3 per month or stick to the basic one which is free of charge.

Another option would be Apple’s Safari browser, a password manager that provides assistance in creating unique and unpredictable passwords for your various accounts. It might also be a good idea to enable two-factor authentication on any account that has this option. You just type in your username and password and then you’ll be requested to enter a code that you receive on your smartphone or email in order to confirm your identity.

It might sound complicated, but it really isn’t!

Spare yourself the trouble with the next one…..

5 thoughts on “9 Items Retirees Should Never Keep in Their Wallet”

The new Medicare cards do not have SS# anymore.

Research shows that once a person relies on electronic currency they increase their spending habits significantly. For sticking to a budget, and putting something away in savings, use of cash is the best policy. You will not spend more than you had planned if you bring along the appropriate amount of cash plus only a “little” extra, and vow to keep the credit cards for emergencies. There is also the aspect of the tangible quality of cash that has a much greater impression on the spender who is trying to be thrifty, as many seniors should be, compared to the ease with which a consumer can rack-up debt with electronic currency or credit cards.

The new Medicare cards do NOT have SSNs on them.

It is easy to ask your bank to remove your address from your personal checks.

Who in the world would carry a birth certificate around?? Or a Social Security card–haven’t we memorized those numbers by now??

I never carry ANY of the things that were advised against carrying in this article.

Cash is Freedom. Most independent Latino businesses only transact in cash.

Nu mai există comentarii de afișat.